Inflation can have a significant impact on the real estate market, including the financing of real estate transactions. As inflation rises, the cost of borrowing money increases, making it more expensive for individuals and businesses to finance real estate investments. In this article, we will explore the various factors that affect real estate financing in an environment of high inflation and offer some tips on how to navigate this challenging market.

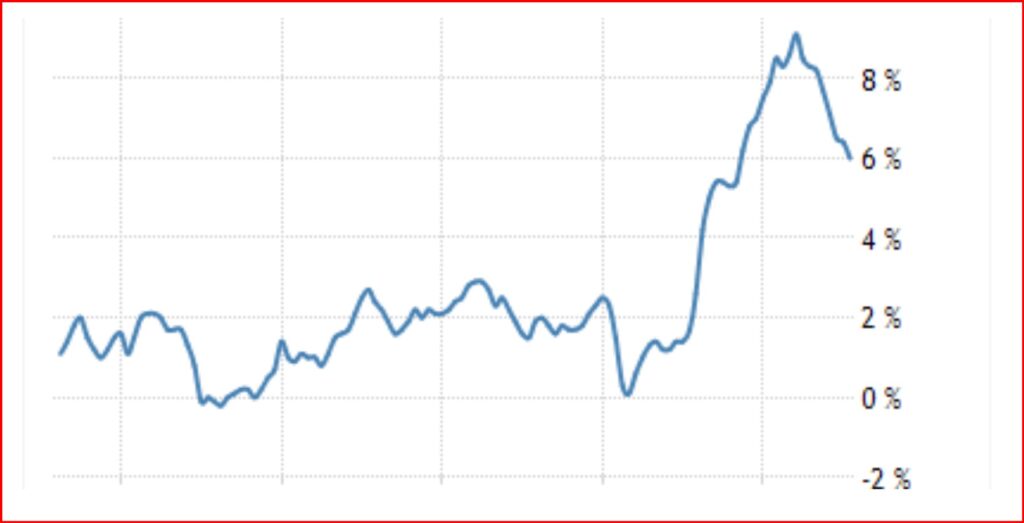

One of the key drivers of real estate financing is interest rates. In an environment of high inflation, interest rates tend to rise as central banks attempt to keep inflation in check. This can make it more difficult and expensive for individuals and businesses to obtain financing for real estate transactions, as higher interest rates mean higher borrowing costs.

“One of the key drivers of real estate financing is interest rates.”

Additionally, inflation can lead to a decrease in the value of the currency, which can make real estate investments more attractive to investors seeking to preserve their wealth. This can lead to increased demand for real estate investments, driving up prices and making it even more difficult for individuals and businesses to secure financing.

So, what can individuals and businesses do to navigate the challenges of real estate financing in an environment of high inflation? Here are a few tips:

- Consider alternative financing options: Inflation can make traditional financing options, such as bank loans, more expensive. Consider alternative options such as private loans, crowdfunding, or seller financing.

- Be prepared to negotiate: With increased demand for real estate investments, sellers may be less willing to negotiate on price. However, it’s still important to try to negotiate favorable terms, such as a lower interest rate or longer repayment period.

- Stay informed: Keep a close eye on inflation rates and interest rates, as they can impact the cost of financing real estate investments. Stay up to date on market trends and consider working with a financial advisor to help you navigate the market.

- Diversify your investments: Don’t put all your eggs in one basket. Consider diversifying your real estate investments across different property types or locations to help spread your risk.

In conclusion, real estate financing can be challenging in an environment of high inflation. However, by considering alternative financing options, negotiating favorable terms, staying informed, and diversifying your investments, you can navigate the challenges of this market and make sound real estate investment decisions.

NMLS No. 983787

Branch Manager

305.781.0721

javila@goalterra.com